If you’ve been paying attention to Tone Deaf over the last five or so years, you may have noticed more than a couple of stories about the mouldering state of album sales in the modern music industry.

Basically, albums aren’t selling. At least, not the way they used to. Labels both major and independent are facing thinning profit margins and are desperate to find new avenues for making money.

One such avenue that’s been highly discussed is touring. Whereas once upon a time artists toured purely to promote an album, the album is now more or less an excuse to get an artist back on the road.

But is it enough? Is touring filling the hole left by declining album sales? It certainly seems to be the prevailing line of thought. Even fans have caught onto the fact that artists now make the bulk of their cash from touring.

To find out whether tours really are making up for lost album revenues and whether the tactic works for all artists or simply the big mega-stars, SeatSmart decided to go ahead and crunch the numbers.

“This study dissects data from the top selling tours and albums of the last 34 years to see where the industry is heading. So how can a band not have a top selling album in decades and still blow everyone else away in tour revenue?” they write.

[include_post id=”451911″]

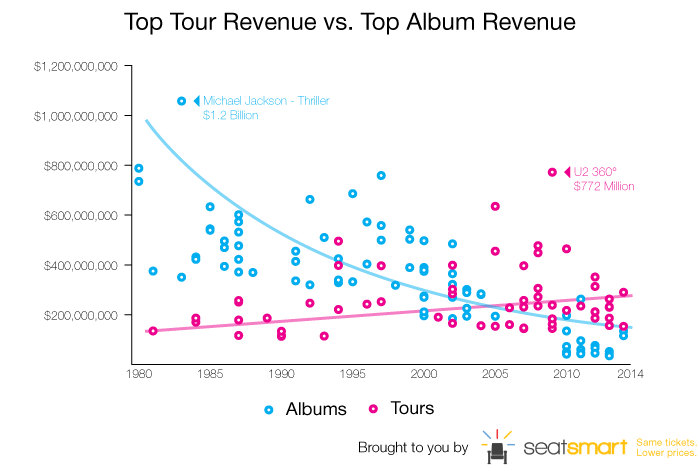

First things first, yes, over the last three and a half decades, album sales have been falling as touring profits have steadily risen. However, as readers can see in the chart below, rising tour revenues aren’t even coming close to compensating for lost album sales.

“For example, look at the top selling album in this study: Michael Jackson’s Thriller. Over its lifetime, that album has grossed over a billion dollars (yes, billion with a “b”),” SeatSmart write.

“Compare that to the top selling album of this decade (the 2010s) so far: 21 by Adele. That album has so far grossed just over $262 million. That means Thriller has nearly four times the revenue of 21.”

“Granted, Thriller has also had more time to accumulate sales, but that certainly can’t fully account for these kinds of differences. After all, the growth in the average revenue for the biggest tours from the 1980s to the 2010s isn’t that substantial.”

In order to get a better idea of how touring revenue compares to album sales, take a look at this chart which compares the two by decade. Tour revenue may be up by just over 50 percent, but album sales are down 84 percent.

What’s interesting to note is that album sales were already in decline even before the digital revolution and the ubiquity of online piracy. “It seems the changes brought on by the internet accelerated that decline,” SeatSmart note.

What’s perhaps even more interesting to note is that while touring revenue is up, ticket sales are in fact down alongside album sales. Album sales are declining far more rapidly, however.

Regardless, the changes in ticket sales are substantial. So how can sales be down but revenue up? Easy. Tickets cost a whole lot more than they did in previous decades. Meanwhile, the price of an album has dropped.

Lastly, taking a look at charts that compare the highest grossing albums to the highest grossing tours, there’s not much overlap. Artists like AC/DC and Madonna do well on both, but the Rolling Stones, for example, rank highly for tours, but don’t even appear on the top albums chart.

There’s also just a small handful of artists who are making the majority of touring revenue, whereas album sales are more evenly distributed. This is of particular concern to smaller artists occupying an industry relying on touring to sustain itself.

[include_post id=”452655″]

“What does it all add up to?” SeatSmart ask, “In short: not enough. While there are some larger trends in the music industry which come to light with this data, what it really tells us is how, comparatively, the best of the best are doing.”

“Concert revenue is up, even if attendance is down. But, all of that goes out the window if you’re someone like the Rolling Stones or U2. Album sales are looking dismal for everyone.”

“Still, perhaps the slight pickup in overall ticket sales seen so far from the 2000s to the 2010s offers some hope. Someone is coming out on top here. It can just be difficult to see who it is.”

What’s clear, however, is that the industry seriously needs to rework its business model or, as SeatSmart note, “If it can’t, there’s no telling how low these numbers may yet go.”