In February, the London-based International Federation of the Phonographic Industry (IFPI) releasing their Digital Music Report, demonstrating that global music sales had experience their first upswing in growth since 1999, which just so happens to be the same year Napster launched while the global music industry was at a $38 billion peak.

The IFPI’s Digital Music Report posted a marginal but crucial 0.3% rise in growth to $16.5 billion, with Chief Executive Frances Moore declaring that the music industry was finally “well on the road to recovery,” thanks largely to growing sectors such as music streaming services, digital sales, and performance rights and sync revenues.

The IFPI has now issued their annual Recording Industry In Numbers (RIN) report, which demonstrates that Australia is one of the world’s most thriving music markets, placing #6 in the world’s Top 10 growing music markets.

While the UK, Germany, France, Italy, and US markets fell, the latter demonstrated by the RIAA’s own recent annual report, showing overall sales fell but were anchored by ‘access models’ (re: online music streaming), Australia experienced a growth of 6.8% in 2012 to AU$ 492.2 million (approx. US$ 507 m) in revenue.

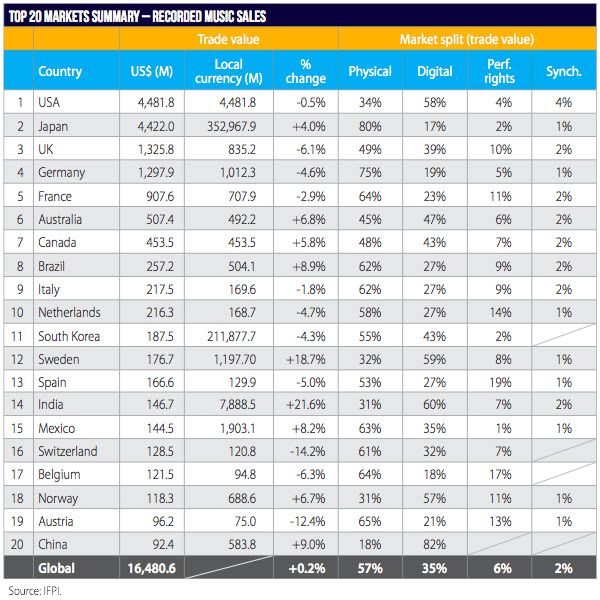

As the handy Top 20 chart via Digital Music News shows, Australia beats Canada’s sales of US$ 453.5 million to the #6 position, sitting just outside the Top 5, which is taken by – in order – USA at the crowning position with nearly nine times Australia’s global sales at $US 4,481.8 million, Japan in the penultimate spot (US$ 4,422m), the UK at #3 (US$ 1,325.8m), Germany (US$ 1,297.9m), and France (US$ 907.6m).

Population wise, Australians are also one of the biggest spenders on music per head than other countries. With a population of 23 million, Aussies spend about $22.04 per head on music. By comparison USA has a population of 313 million, so Americans spend per head about $14.30 on music, Japan has a population of 127 million ($34.80 per head), UK a population of 63 million ($21.03 per head), France has 65 million people ($13.95 per head), and Canada 35 million ($12.94 per head).

Speaking of the RIN report’s figures, the IFPI’s Frances Moore said the study “reveals the sheer diversity of the modern music business,” including the “increasing role of subscription services and the growing importance of emerging markets in driving the industry’s recovery.”

The figures also demonstrate that physical sales and digital sales in Australia were nearly neck and neck (as ARIA demonstrated in their 2012 sales report), positing that 47% of the generated revenue of AU$ 492.2m was from Digital, while Physical was still high at 45%. By comparison the United States showed a 34%/58% split to Digital and Physical respectively, while Japan vastly prefers CD and vinyl to digital purchasing with an 80%/17% split; likewise Germany (at 75%/19%) and France (at 64%/23%).

According to Billboard, Australia’s 6.8% growth was one of nine total countries that experienced a leap in global revenue in the Top 20, alongside Sweden (US$ 176 million, up 18.7%) and – at its highest-ever sales level, India (US$ 146 million, up 22.1%), who both moved up the rankings to #12 and #14 respectively.

Other markest that grew in 2012 include Norway (US$ 118 million, up 6.7%) and China (US$ 92 million, up 9%) which re-entered the Top 20, replacing South Africa at the final spot on the list. The IFPI’s RIN report… demonstrates that Australia is one of the world’s most thriving music markets, placing #6 in the world’s Top 10 growing music markets.

According to the IFPI’s RIN study, all revenue streams grew in the last twelve months, with the exception of physical sales, backing up the figures from February’s Global Music Report. Global digital revenues were up 8% to $5.8 billion, climbing from US$ 5.4 billion in 2012. Performance rights revenue grew 9.4% to US$ 943 million, making it the fastet growing sector, while sync revnue inflated to US$ 337 million, growing 2% up from $330 million in 2012.

Despite experiencing a drop in 5%, from 2011’s total of US$ 9.9 billion to 2012’s figure of US $9.4 billion, physical sales still accounted for more than half of global music sales revenue, at 57% while digital music sales – of which album downloads remained the lion’s share – accounted for 35% worldwide.

As can be seen by the swathe of new blood entering the music streaming market – including IT giants like Apple, Google, Twitter, online retailer Amazon, and Beats Electronics’ Trent Reznor-helmed ‘Daisy’ – on-demand digital subscription services are experiencing rapid growth.

Their cultural and economical impact on the music industry continuing to rise, with IFPI’s RIN study showing that music subscription and ad-supported streaming services account for 20% of digital revenues globally, showing a 6% leap from the 14% posited in 2011. In Europe, the birthplace of music streaming services two market leaders – Sweden’s Spotify and the French-based Deezer – subscription and ad-supported revenues are the most burgeoning, accounting for 31% of all digital music revenue.

Closer to home, Australia’s growth is to be championed as one of the world’s most thriving music markets, but both IFPI and Australia’s ARIA have voiced concerns that music piracy was still a primary concern Down Under, a problem they caution will worsen with the impending roll-out of the Federal Government’s National Broadband Network.

ARIA CEO Dan Rosen shared the IFPI’s concerns, saying that if consumers continued to flaunt music piracy, it wasn’t just the music industry that would feel the ill affects; “it’s all Australian content industries.”

He emphasised that copyright protection and the interests of artists needed to reman priority, estimating that “between 30 and 40 per cent” of internet users were still accessing “unauthorised websites,” over legitimate music sources such as iTunes or streaming services like Spotify and Deezer. Adding that the shift was necessary “so that the money from sales flows back to the people who created the work and not unauthorised websites.”

In a more positive light however, the new 6.8% growth in Australia’s music market reinforces figures from ARIA’s 2012 industry report showing a marked increase in digital sales and performance rights revenue, predicting that digital music sales are set to overtake physical in the very near future.

You can purchase the IFPI’s Record Industry In Numbers 2013 report here.