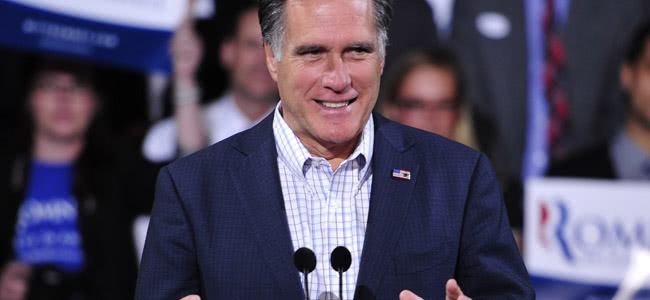

Bain Capital, the private equity firm founded by US republican presidential candidate Mitt Romney, is reportedly circling collapsed music retailer Allans Billy Hyde in what could be an eleventh hour reprieve for hundreds of workers whose jobs are on the line.

The news comes as receivers Ferrier Hodgson begin the wind down the company amidst massive debt and unprofitable stores, laying off 56 jobs predominantly at the head office in Rowville, Melbourne.

The group lost $40.9 million in the year to July 3, 2011, the latest period for which accounts are available.

In an ominous sign for the business, receivers have announced the immediate sale of about $45 million in stock cleared for discount, and have openly admitted the restructure is the first step to them winding up the company.

But according to the former managing director of the group, John Helme, discussions continue about a sale and moves by recievers to shut all company stores and lay off over 600 staff are ‘premature’.

“A number of discussions are ongoing with interested parties,” Helme told The Sydney Morning Herald, declining to comment on market speculation that Bain Capital was among those interested in purchasing the group.

It’s been only a few weeks and the local music industry’s head is still spinning following the unexpected and shocking news that music store group Allans & Billy Hyde had entered receivership amidst debts of nearly $40 million.

Ferrier Hodgson partners James Stewart and Brendan Richards were appointed as the administrators of the receivership by secured creditor Revere Capital, which is owed $27 million by AMG (owners of Allans & Billy Hyde), and the pair had hoped to sell the business to service the debt.

While the restructure is designed to prepare AMG for eventual closure, the Receivers, Ferrier Hodgson partners James Stewart and Brendan Richards, remain in discussions with interested parties in case a last minute sale saves the business.

“Last week’s news was premature from our perspective,” Helme added. “We remain hopeful that there will be a credible buyer. With such an iconic business you have to question such a hasty decision.”

Receivers say that the controlled closure process will see the AMG business, which incorporates Allans Billy Hyde, Musiclink and Intermusic, wound up over the next few weeks.

Stage Systems is not in receivership and will continue to trade normally. The Allans Billy Hyde franchise stores are independently owned and are not in danger of closure.

“After serving consumers and the music industry for generations, the likely closure of the business and the loss of these jobs is very disappointing for all concerned,” a spokesperson for the receivers said.

“We will work with the Administrator to enable affected employees to make claims for their entitlements through the Government Entitlements and Redundancy Scheme (GEERS) as quickly as possible.”

There are 24 company-owned stores around Australia, including eight in both Victoria and New South Wales.

The news of the company’s receivership comes only two years after their merging, with the two businesses combining forces in July 2010 to face down financial struggles to begin with.

Despite annual sales of $110 million as of June 30, Mr Stewart said the music stores had been affected by “the decrease in consumer discretionary spending currently being felt by many Australian retailers.”

Allans Music has a history as a music retailer for over a century-and-a-half, established in the 1850s when Joseph Wilkie and George Allan opened a music warehouse in Melbourne’s Collins Street.

Billy Hyde was first formed by the titular drum manufacturer, who perfected his production line of drum kits in the 50s and 60s, opening his first store in Melbourne’s Flemington in 1962.