Many musicians have fallen on hard times in recent years. Increased competition and decreased sales have resulted in the music industry not being quite as lucrative as it once was. But an innovative new platform is reasoning there is a new method for songwriters to earn money from their craft.

The Royalty Exchange is a website that specialises in the buying and selling of royalties from music, movies, books, trademarks, and patents. The idea is that musicians auction off the rights to their music and investors can buy into the royalties of a song, and therefore receive a cut of what that composition earns in the future. This provides a source of upfront cash for the artist, rather than the steady trickle that pays off from royalties.

Essentially, its a more immediate form of cash flow, instead of waiting for the profits from a song to come through the pipeline, musicians can use the website to sell off a share of their long term royalty earnings up front for a short term source of cash. Essentially using the up front money to feed back and reinvest in the music making process – such as production, recording, and distribution – to continue to make more songs, and thus more royalties, which in turn can be sold off.

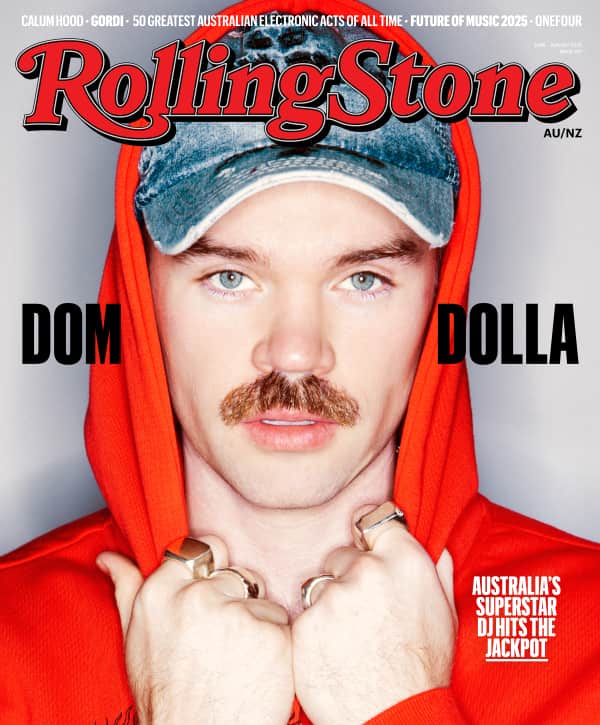

One creative singing The Royalty Exchange’s praises is Preston Glass, former producer for singers such as Natalie Cole, Aretha Franklin, and Whitney Houston, who turned to making music himself but struggled to find the upfront cash to purchase the equipment he needed.

He explained to the New York Times that it can be difficult to raise or borrow money when royalties are not widely understood. “Me and most writers can’t walk into a bank,” he said. “Banks don’t understand how songwriting works, how the whole business of royalties works.” “Me and most writers can’t walk into a bank, [they] don’t understand how songwriting works, how the whole business of royalties works.” – Preston Glass, Producer

With the help of this new website, Mr Glass was able to raise US$ 158,000 by auctioning some of the songs he helped to write. This included ‘Miss You Like Crazy’, made famous by Natalie Cole in 1989. Mr Glass maintains most of the rights to his songs, but now shares some of the revenue with an investor, with revenue coming from radio airplay and online streaming.

The Roylaty Exchange has been around for two years and has helped raise US$ 750,000 in that time, according to the NY Times. Sean Piece, the company’s founder and CEO, says it’s unfortunate “most musicians have no idea that they can take their royalties and reinvest in themselves.” He explained that “if they could get $80,000 up front for selling 50 percent of their royalties, that can be game-changing.”

However, Eli Ball of Lyric Financial warns against bands selling their rights too quickly. “It’s too easy for songwriters to sell off an asset that took you a career to build and is going to be gone forever,” Mr. Ball said. And with good reason.

There have been plenty of situations in the past where cash-strapped musicians have sold their music rights for far less than they’re worth. His company, Lyric Financial, instead gives advances on royalty cheques for a fee, so that the rights of the songs never actually change hands but musicians can get access to finances quickly and efficiently.

In either case it’s important to know exactly what is occurring in the transaction, says Mr Ball, and be clear about what the artist and investor are getting back. As far as The Royalty Exchange goes, their auctioning services earn themselves money from both parties. Specifically, 2.5% of future revenue from the investor and as much as 12.5% from the artist. “Most musicians have no idea that they can take their royalties and reinvest in themselves.” – Sean Piece, The Royalty Exchange

It can be a tricky business, as Michael S. Simon – chief executive of the Harry Fox Agency – stressed, the importance of knowing how copyrights work and how legislation changes can affect these issues. “You need to understand life of copyright, you need to understand the potential ramifications of legislation that could affect life of copyright, and you need to understand termination rights,” he said.

For this reason Mr Simon believes it might be difficult for someone outside of the industry to be able to identify what may be a good investment.

That was not the case for Martin Diessner, an investor who lives in South Africa who bought half of Preston Glass’ song rights up for auction. He felt that being an outsider gave him a clearer view. “The reason why I think it’s less risky is probably because I don’t understand the music industry,” said Mr. Diessner. “Everyone who is in the industry sees it from the inside out, while I see it from the outside [in] and maybe don’t have a negative perception.”

With the success of online streaming services and crowd-funding projects, it’s not surprising that struggling musicians are so quick to jump on board something that promises more zeroes to the digits in their bank accounts, and with The Royalty Exchange, musicians are afforded a new way to be able to make money from their craft.

Whether it’s entirely a good thing, or another model of profiteering from people who don’t necessarily invest in the creation of music, simply it’s funding – is yet to be seen. It might be a little money-hungry, but if it means that artists are able to keep making the music we all love, how bad can it be?